Risk-Calibrated Portfolios

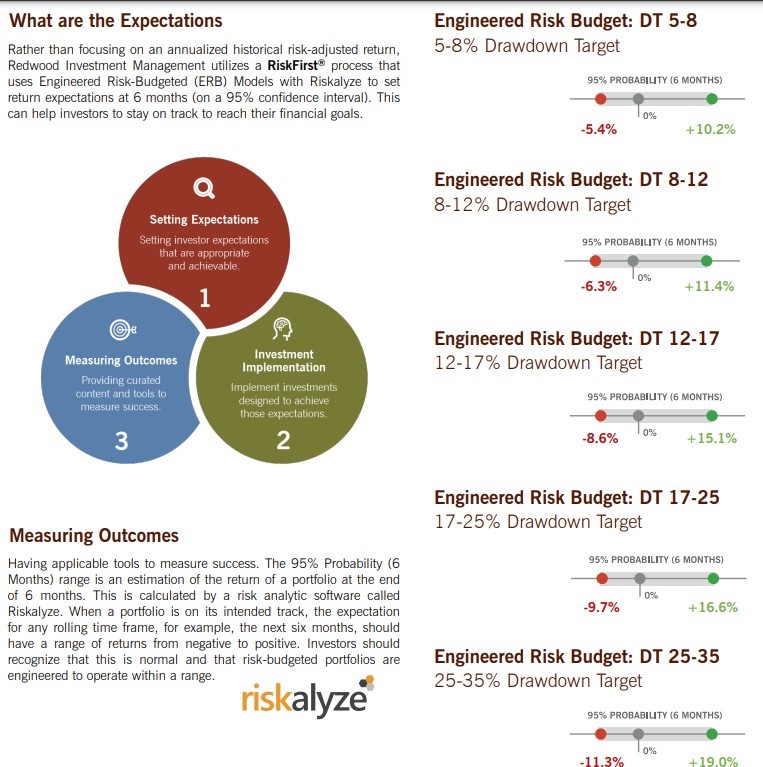

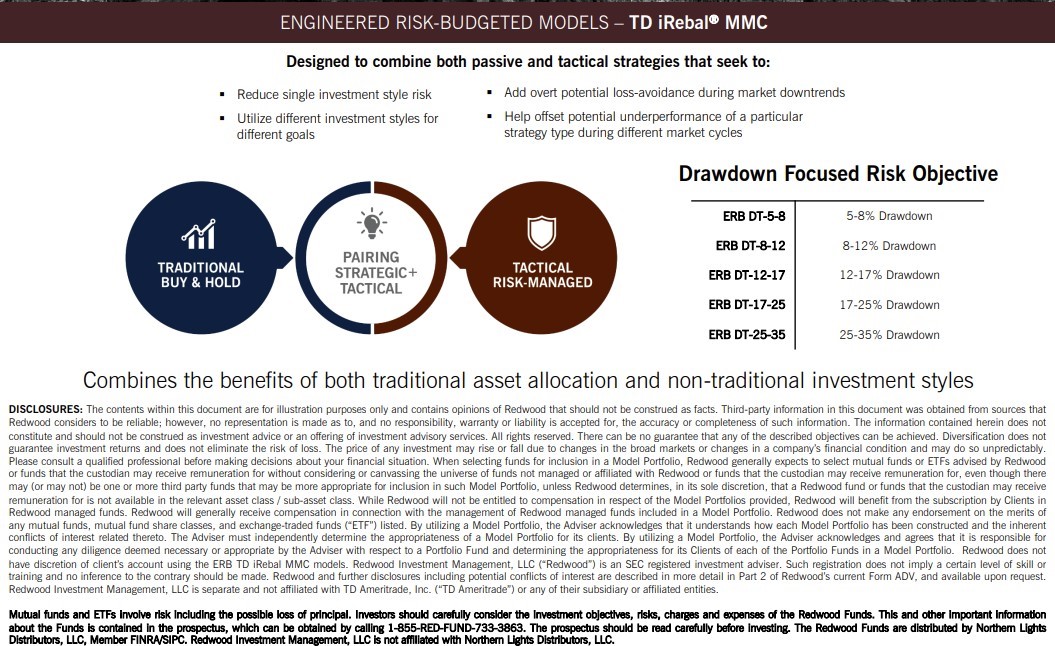

Shorebreak Capital, LLC., offers five risk-calibrated portfolios engineered to meet the following drawdown perimeters with 95% probability: (5 -8%, 8-12%, 12-17%, 17-25%. managed by Redwood Investment Management ($2.4 billion of assets under management) at a reduced fee of 50pbs. The portfolios invest across all asset classes, sectors and industries with a focus on the goals and outcomes that matter most to you.

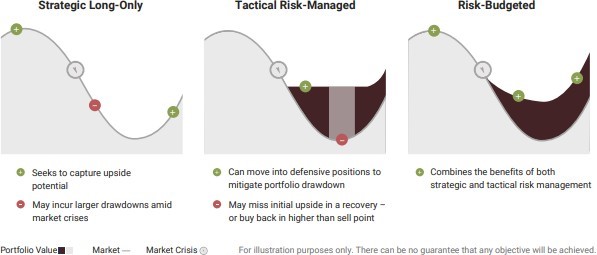

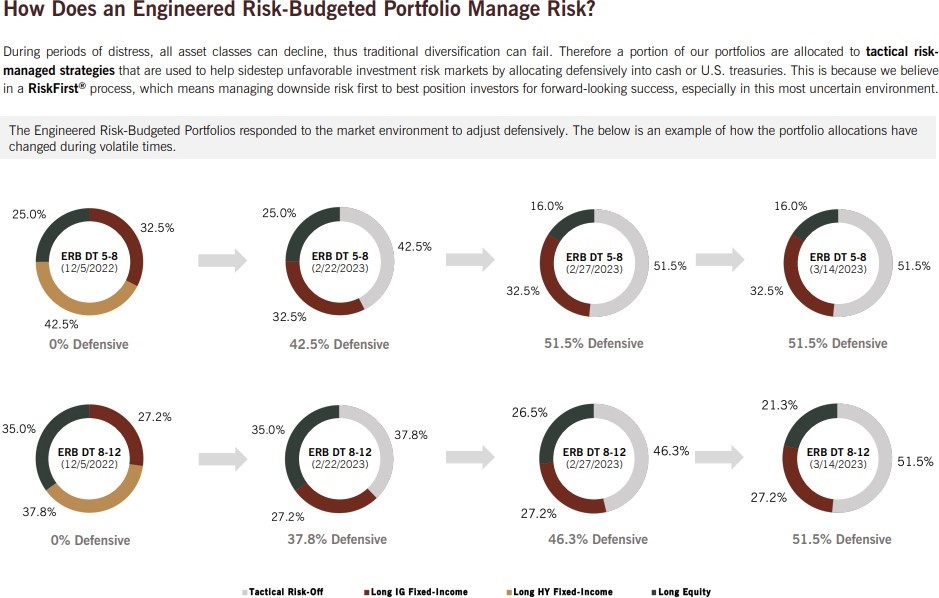

This well-designed platform gives you the most precise expectations for growth as well as drawdown risk. The below diagram shows the Engineered Risk-Calibrated Portfolio. As you can see, each portfolio has a Drawdown Target which allows you the best way to manage the risk and growth expectations of the portfolio. Along with the drawdown maximum, there is a corresponding range for growth. As equity exposure increases within the portfolio, the growth is potentially higher but along with the potential gain is a greater range of risk, as demonstrated below.

The attached pdf below demonstrates the importance of controlling risk, calculates gain required to break even after a drawdown and traditional asset allocation blends with their corresponding maximum drawdowns.

Download performance brochure here.

Download the “Managing Drawdown Risk” report here. This report discusses the engineered risk-calibrated portfolios and how they performed in crisis environments historically.