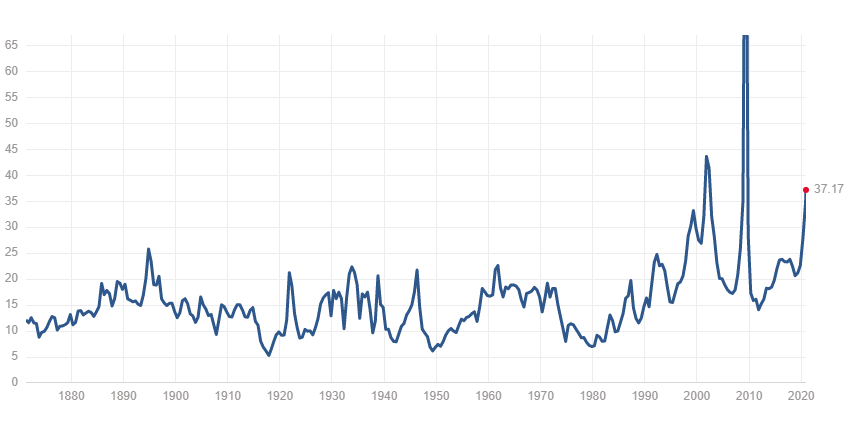

U.S. Equity Evaluations Continue To Climb To Historic Highs

The S&P Price to Earnings Ratio is currently at historic highs, suggesting extremely rich valuations and a possibility of an asset pricing reset in the coming years. P/E ratios are likely to follow historic precedent and revert to their historical average of 15x earnings. If so, this would cause a significant drop in the stock and bond market. Diligent advisors and portfolio managers should have a contingency plan to derisk and hedge your portfolio, as well as a plan to potentially profit when our current bubble bursts and valuations are reset.

Historical PE Ratio Chart

Source:https://www.multpl.com/s-p-500-pe-ratio