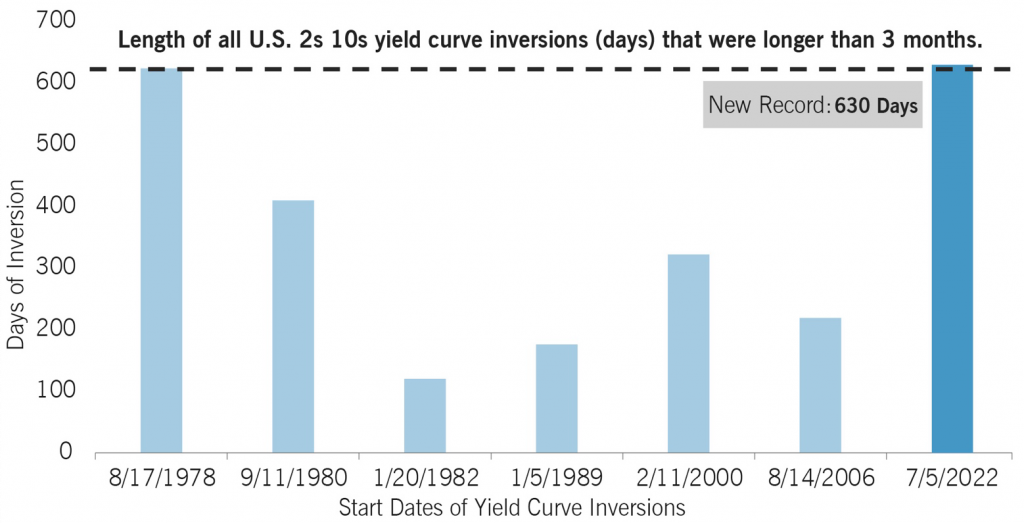

“Yield-Curve Inversion,” occurs when short-term bond yields surpass those of long-term bonds. This unusual pattern, exceeding over 630 days, marks the longest period of inversion since 1970, highlighting investor concerns about the near-term economic prospects.

Historically, these inversions have often preceded economic recessions, though they are not foolproof indicators.

At Redwood, we are vigilantly monitoring this situation. Our RiskFirst® approach is geared towards ensuring that our strategies are well-prepared to navigate potential downturns, always keeping your investments secure.

630 Days Inverted: Length Matters?

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: