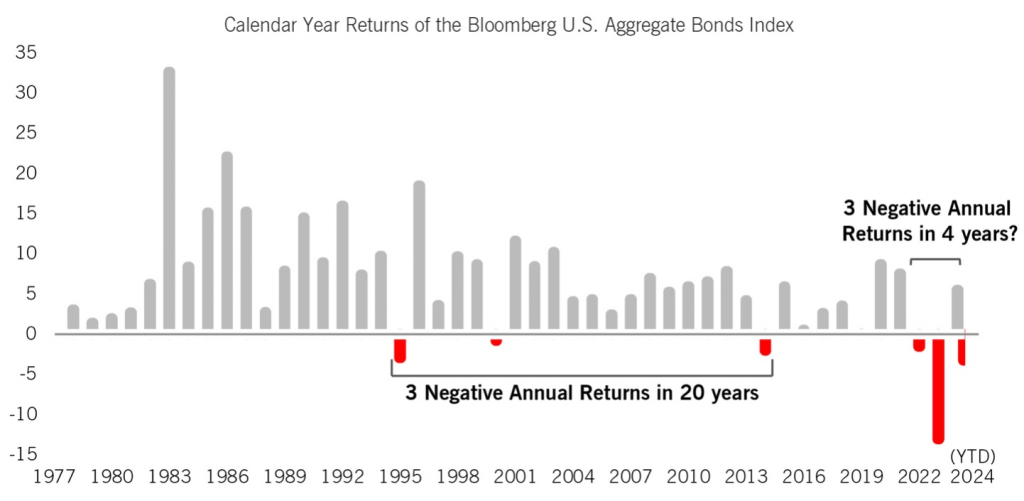

The Bloomberg U.S. Aggregate Bond Index, known for its stability and consistency, has seen an unusual uptick in volatility. Before 2020, the Index only had three negative calendar years since its inception. Recently the frequency of negative returns has increased significantly.

In fact, the Index is on track to notch its third negative year in the last FOUR years. This shift has deterred investors, who are now wary of the minimal returns and heightened risk of losses associated with public investment-grade bonds.

Our RiskFirst® approach ensures careful management of exposure to these assets, seeking to optimize their value for our investors. We will continue to monitor risk and navigate this new fixed-income landscape.

Navigating New Norms

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: