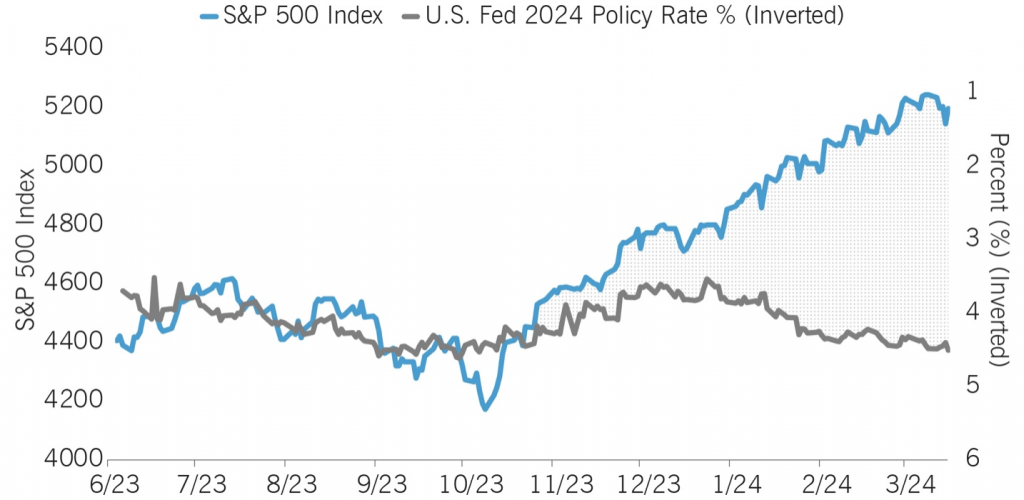

Stock prices and Federal Reserve interest rate cut expectations were moving together until recently. Now there is a divergence due to a change, in that market participants believe the Federal Reserve might postpone or slow the pace of interest rate reductions, but the stock market has continued up.

The question for many is whether the stock market will maintain its upward climb or adjust downwards with the change in rate cut expectations.

Since the future market direction is unpredictable, we are prepared for any scenario. Our RiskFirst® approach is designed to participate in market growth phases while navigating through the potential market dips that inevitably come.

Stocks Rise Despite Rate Cut Hopes Cooling

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: