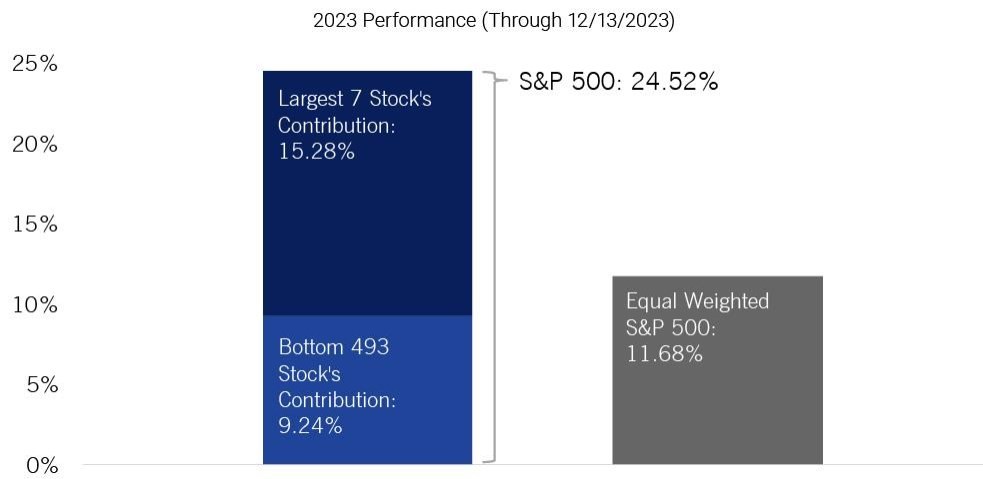

As the year winds down, headlines often scream about record highs, double-digit returns, and the market’s fantastic performance. But these catchy headlines rarely tell the full story of what’s happening in the investment landscape. Let’s focus on the S&P 500 this year-it’s shown a 24% increase.

However, surprisingly, more than 15% of this return comes from just 7 companies. The other 493 companies? They’ve only contributed 9% of the total performance of the index. If we give each company equal weight in the index, the performance drops to around 11%. Here’s why this matters: while headlines boast about an amazing market, it’s 7 companies that are doing exceedingly well, while the rest perform moderately at best.

Straying from your financial path in pursuit of high performance can often lead to unintended consequences. Aspiring for the extraordinary returns witnessed by the top 7 stocks this year comes with a significant trade-off: being exposed to the same exponential downside risk as the potential upside.

Recall that in 2022, these 7 companies collectively experienced a notable 49% downturn, significantly impacting the broader index. This reiterates our steadfast dedication to the RiskFirst® approach.

We dig beneath the surface of attention-grabbing headlines to comprehend the genuine complexities and risks hidden behind them. Our foremost priority remains offering a well-informed perspective, focusing on comprehending the authentic market dynamics instead of succumbing to sensationalized narratives.

Reality Check

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: