The S&P 500 has surpassed its previous all-time high, and our fully invested models have successfully capitalized on this rally.

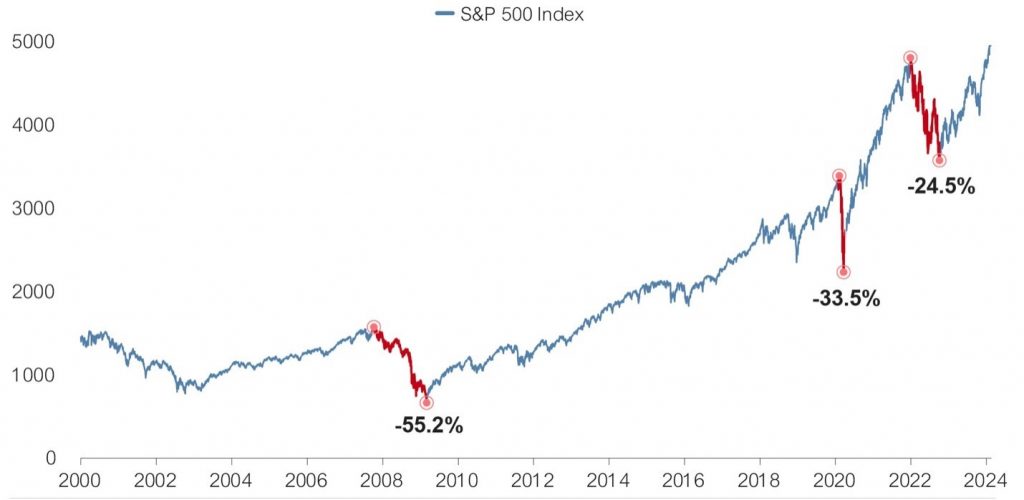

As we have seen, historical trends in the S&P 500 have shown significant drawdowns exceeding 50%.

Our RiskFirst® process is designed to be mindful of these patterns, with the goal of managing downside risk to stay in line with our client’s financial goals.

At Highs, But Risks Still Exist

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: