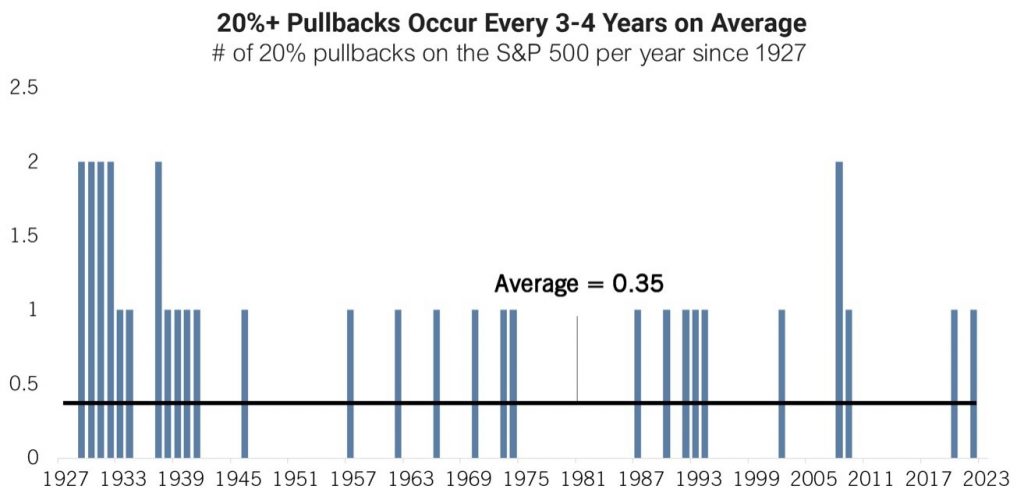

“Fat Tail Risks” refers to the rare chance of experiencing extremely large losses, far beyond what is normally expected in the market. When we look at how many 20% pullbacks occurred in the S&P 500 Index throughout the years, we can see that it happens around 0.35 times per year. This translates to at least one bear market every 3-4 years, more often than some might expect.

This highlights the importance of managing downside risk, even if we know these drops happen occasionally, no one knows exactly when they will happen next.

At Redwood, our RiskFirst® process prioritizes being ready for any market environment, aiming to help our clients handle these inevitable downturns without exceeding their comfort level.

Frequency of “Fat Tails”

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: