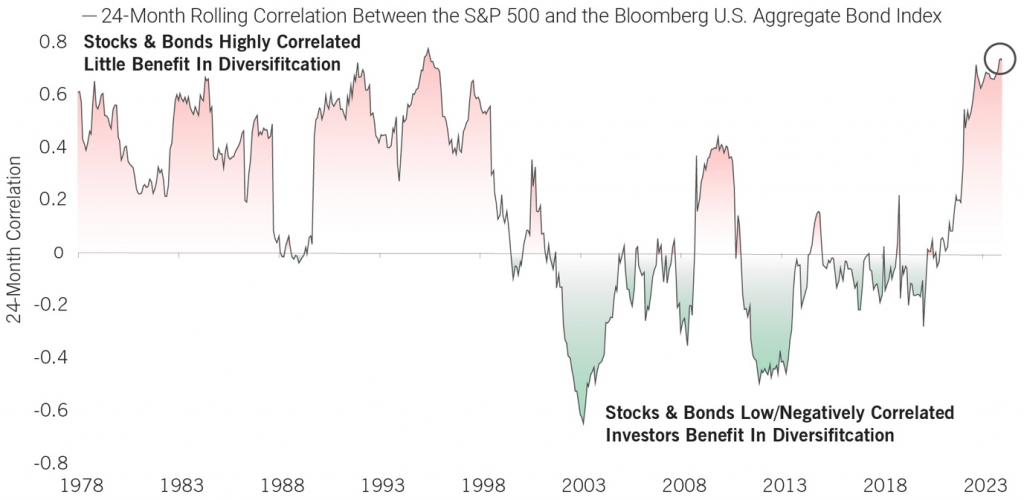

Traditionally, stocks and bonds have played a seesaw game – when one rises, the other tends to fall. This dynamic has been advantageous for investors like yourself. This strategy is known as “diversification,” a key principle in managing investment risk.

However, stocks and bonds have been moving in the same direction recently. Between the S&P 500 and the Bloomberg U.S. Aggregate Bond Index, the measure that shows how similarly two assets perform, also known as “correlation”, has reached its highest point in over 30 years!

Why does this matter? Well, if both types of investments move together, it’s harder for investors to spread out their risk. It’s like putting two eggs in two separate baskets, when one basket falls, the other does too.

Being able to mitigate downside risk with other methods outside of traditional diversification is exactly what we focus on here at Redwood. By combining non-correlated assets with tactical sub-strategies, our RiskFirst® process can help clients manage risk and assist them along their financial journey.

Eggs in One Basket?

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: