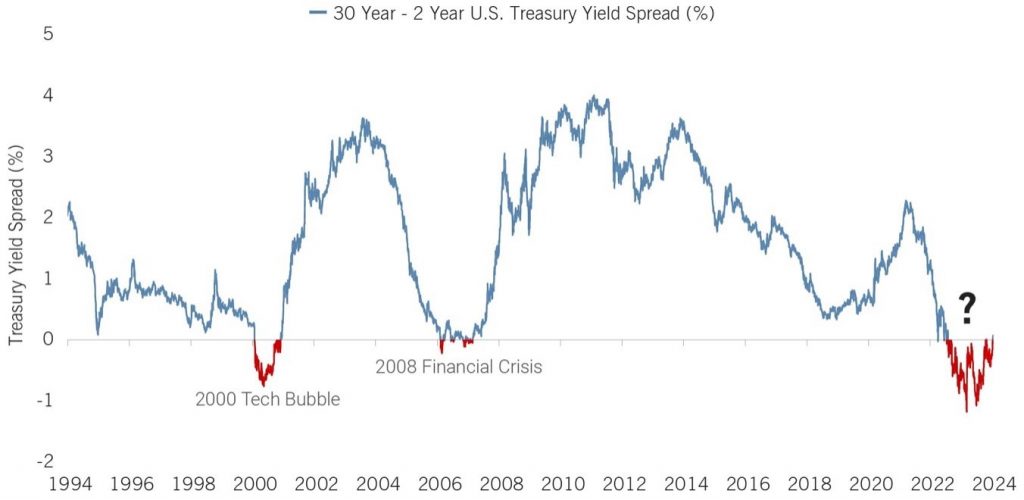

Treasury bond yields are the interest rates the government pays on its debt, varying with the term of the loan, from short to long durations. Typically, longer-term bonds, like the 30-Year ones, offer higher interest rates than shorter-term bonds, such as the 2-Year ones.

This is expected, as investors demand higher returns for lending money over a longer period. However, there are times when this trend reverses, a phenomenon known as a “Yield-Curve Inversion.” This occurs when short-term bond yields exceed those of long-term bonds, signaling investor concerns about the near-term economic outlook.

It’s important to note that such inversions have historically been precursors to economic downturns, though they are not definitive predictors. The recent occurrence of this inversion is a development we are monitoring closely. While history doesn’t always repeat itself, it often provides valuable insights.

Here at Redwood, we focus on prioritizing risk management and being able to navigate through varying market conditions with the goal of helping clients along their financial journeys.

Tales In The Treasury Curve

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: