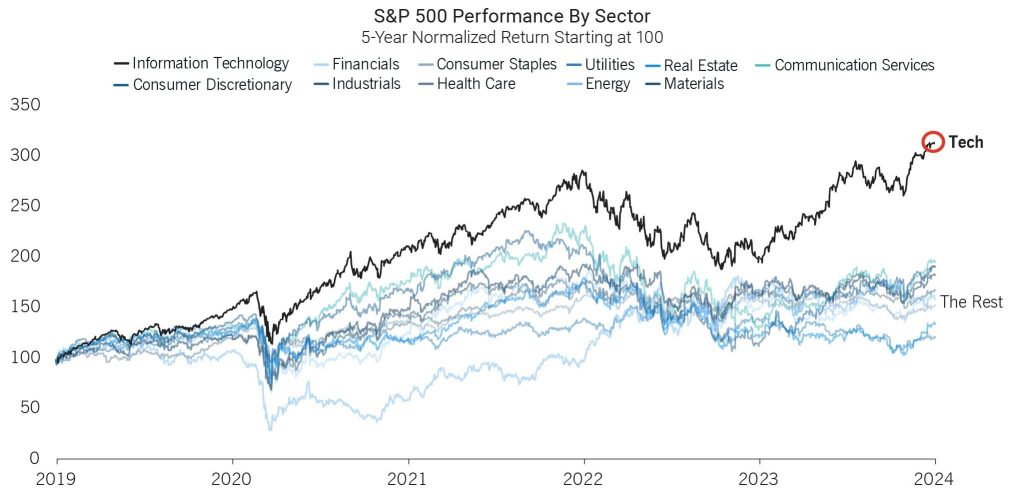

As we analyze the historical performance across different sectors within the S&P 500, a prominent trend emerges: the technology sector has significantly outperformed others. This sector, unlike most, has not only surpassed its 2021 performance level but has done so by a considerable margin. Other sectors have shown more modest growth, making the disparity in performance quite stark.

Even though the S&P 500 is at peak levels, technology and industrials are the only sectors within the Index currently at all-time highs. It’s remarkable that one sector’s performance can so profoundly propel the entire Index to such heights, underscoring its outsized impact in the current market landscape.

However, this dominance of the technology sector brings to light a significant concern: the risk of drawdowns. It’s notable that the drawdowns in the technology sector are often more severe compared to other sectors. Yet, there is a tendency among investors to overlook these risks, primarily driven by the allure of high returns.

This scenario highlights a common investor bias – focusing on potential gains while underappreciating the associated risks. Here at Redwood, our RiskFirst® approach is designed to follow a disciplined, quantitative approach to our strategies. Our goal is to help clients stay within their risk appetite while guiding them throughout their financial journey.

Unsustainable Outlier?

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: