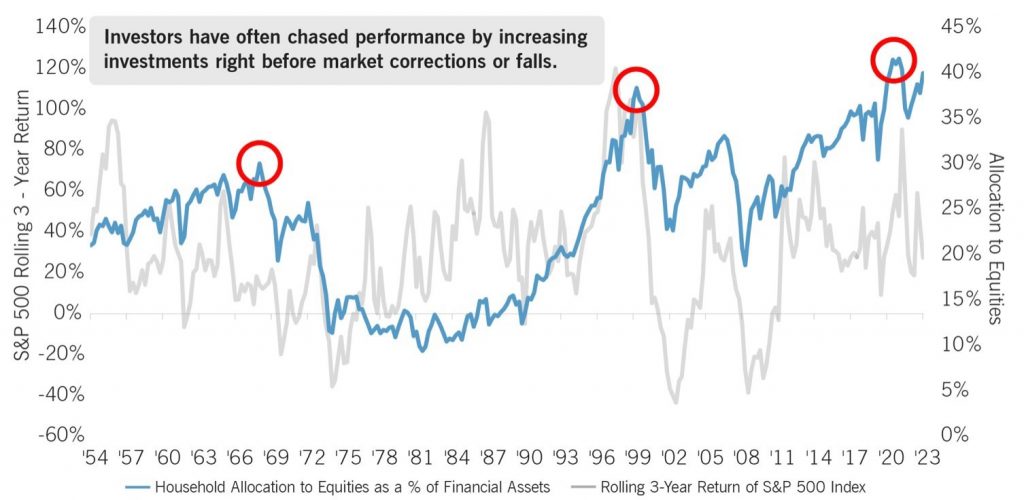

In recent times, the surge in market performance has sparked a familiar wave of FOMO-fear of missing out-among investors, compelling many to rethink their strategies in pursuit of higher gains. Historical patterns reveal a tendency for households to shift significantly towards equity securities during these bullish phases, often driven by the allure of immediate returns.

However, this shift frequently coincides with market peaks, followed by downturns, highlighting a common pitfall: poor timing. The core issue lies not within the market’s ebb and flow but in the abandonment of disciplined investment processes amidst market noise.

At Redwood, we emphasize the importance of our RiskFirst® process, designed to foster discipline and mitigate impulsive decisions. Our approach aims to safeguard your investments by prioritizing risk management and maintaining a strategic focus, regardless of market environment. Remember, the key to successful investing is not chasing the stock market but adhering to a principled strategy that aligns with your long-term objectives.

Emotional Investing Pitfalls

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: