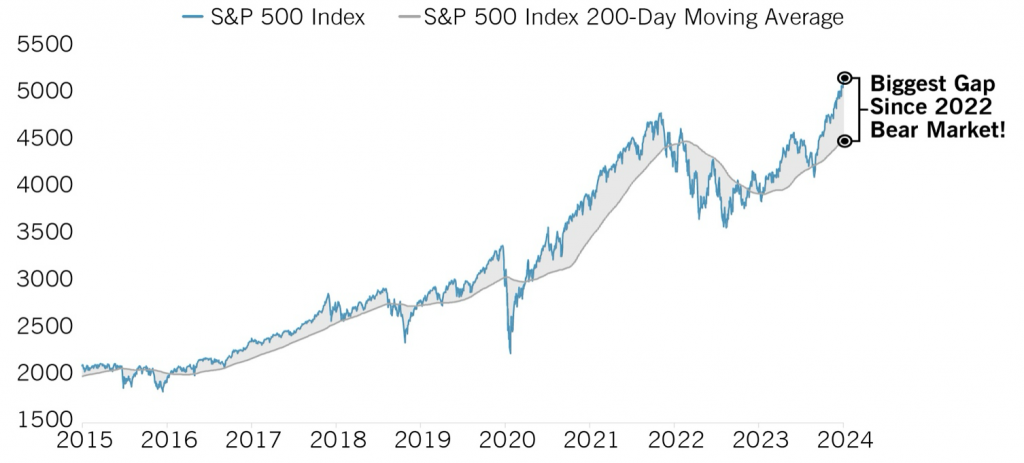

In finance, the “Moving Day Average” averages the prices of a security over a certain number of days (like 10, 50, or most commonly, 200 days) and this helps people see the overall trend of the market. Yet the market, namely the S&P 500 Index, has seen a significant uptick recently, climbing notably above its 200-Day average price. In fact, the S&P 500 and its 200-Day Moving Average is at its widest distance since the 2022 Bear Market, possibly signaling caution.

This surge could lead investors to chase after gains, driven by the fear of missing out. However, it’s easy to overlook risk when the market is on the rise. True risk-tolerance often becomes apparent during downturns. Here at Redwood, we emphasize risk consideration consistently, regardless of the market condition. While we aim to capitalize on upswings like these, managing risk remains a key priority.

Risk Reality Check

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: