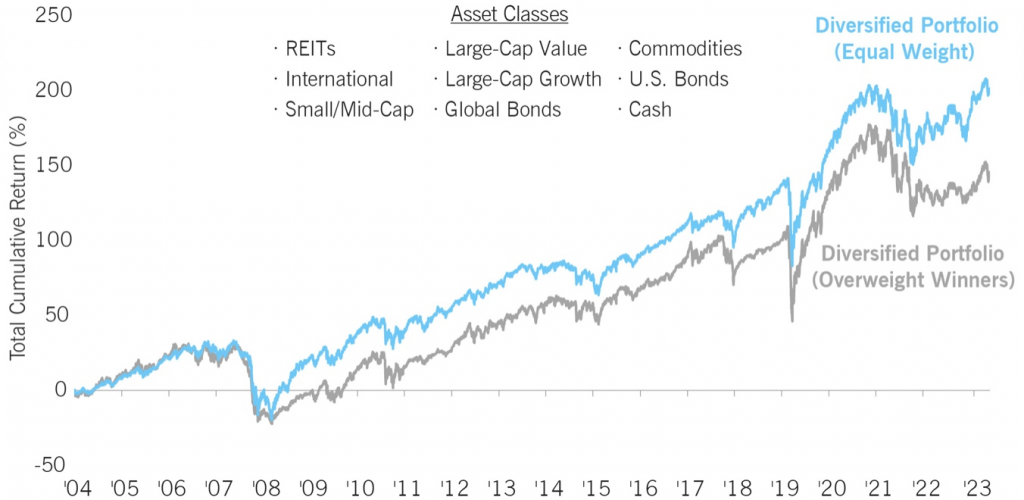

It can be tempting to invest in the recent best-performing investments being heralded by media. Unfortunately, research demonstrates, that investing in recent top-performing assets leads to less-than-expected outcomes.

See the chart below, which illustrates sticking with a disciplined plan has historically outperformed chasing the most recent best-performing investments.

Shifting Allocations = Poor Results

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: