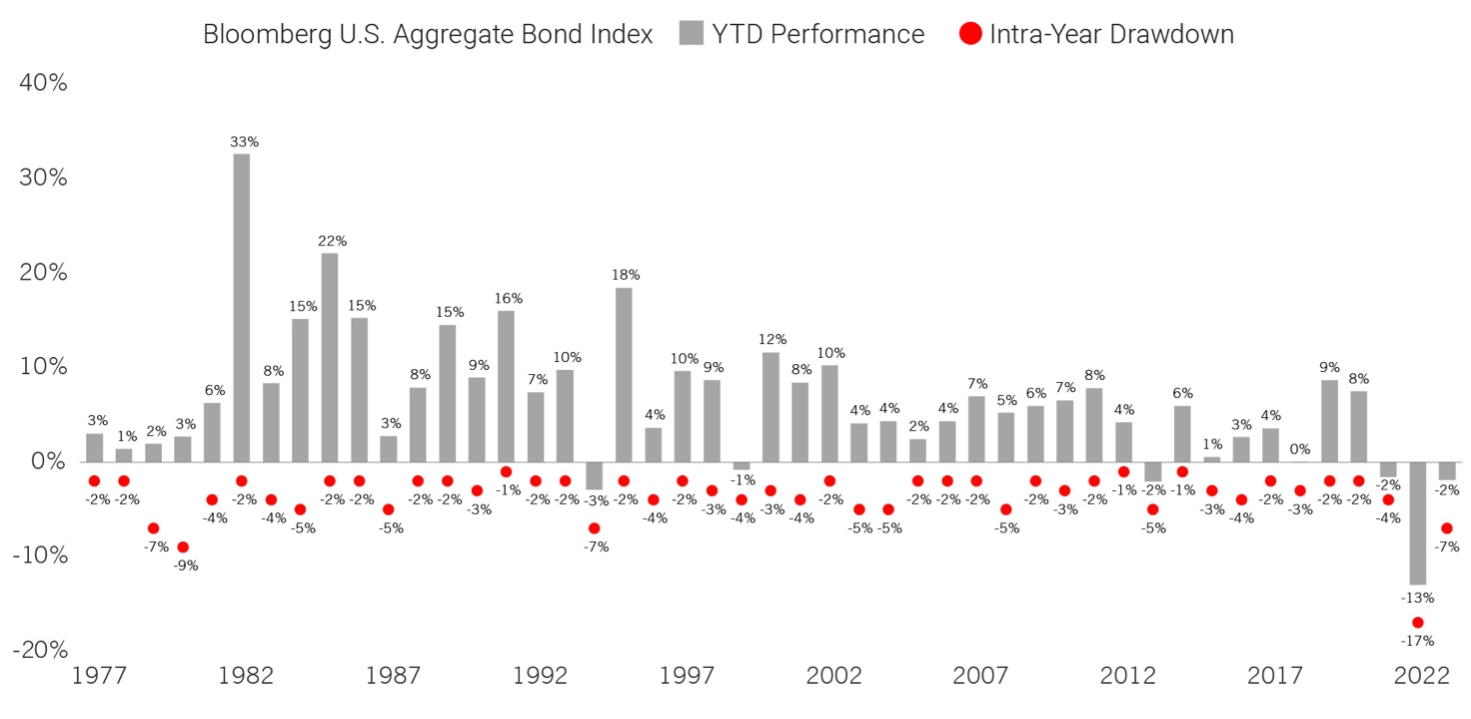

Higher interest rates are poised to pose a significant challenge to the high-grade investment-grade bond market, particularly those sensitive to interest rate changes. Looking at the Bloomberg U.S. Bond Index (AGG), which encompasses investment-grade corporate bonds and treasuries, it’s evident that the past year was far from smooth sailing. The most substantial drawdown the index experienced was 17%, concluding the year with a 13% loss. This marked the first time in the index’s history that it recorded back-to-back negative annual returns.

The story continues into this year, with volatility levels still quite elevated. The most considerable drawdown, or peak-to-trough loss, is currently at 7%, representing the third-largest intra-year drawdown since the index’s inception. To make matters more concerning, the AGG has been in a drawdown for the past three years, precisely 1,165 days, highlighting the persistence of these turbulent times.

These recent developments are a clear signal to investors who traditionally rely on investment-grade bonds and treasuries as a safe haven. Higher volatility means investors need additional risk mitigation strategies beyond the conventional methods. We employ a range of strategies that seek to mitigate risk, including tactical mandates and alternative assets. Our aim is to help our clients stay within their risk tolerance while navigating these challenging market conditions.

Another Historical Drawdown?

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: