2022 served as a stark reminder of the challenges inherent in traditional fixed-income investments. The dramatic double-digit declines experienced by treasuries and investment-grade bonds raised concerns, particularly for those who consider these assets as reliable safe-havens.

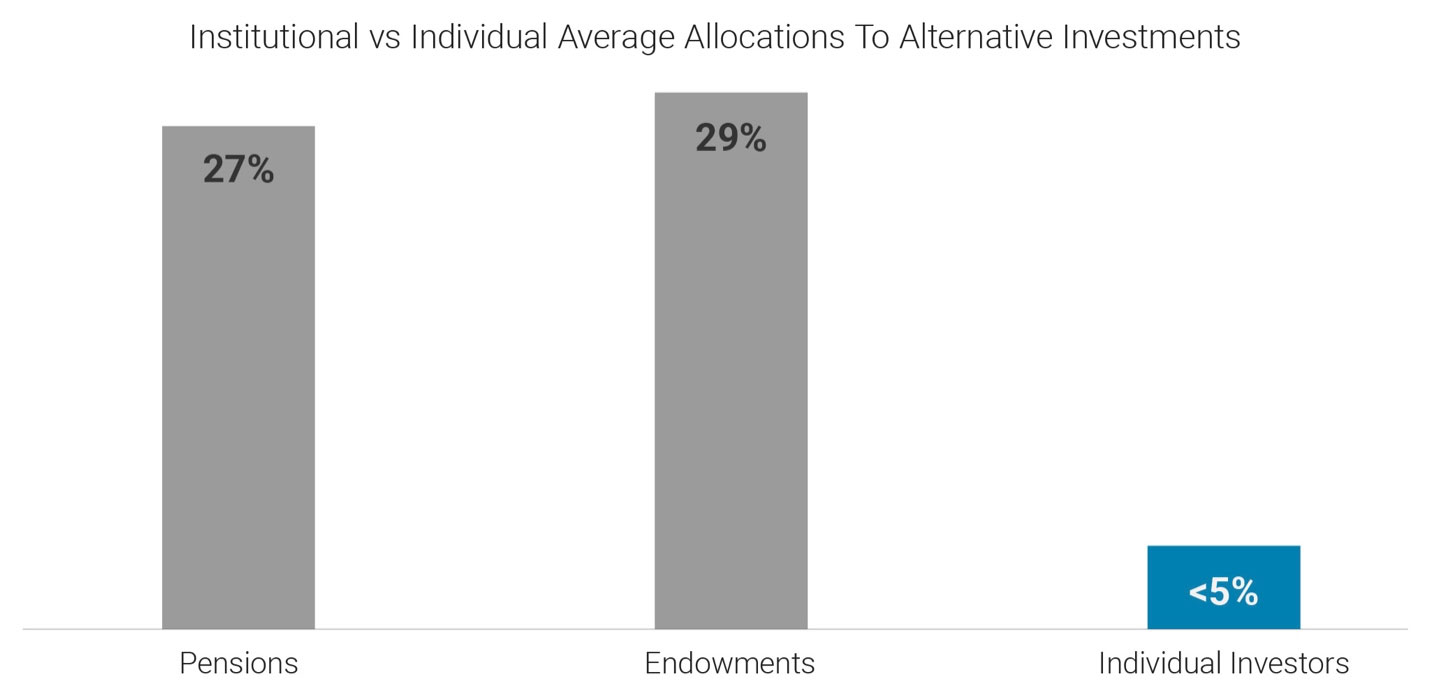

This left investors with few options because while viable alternatives like private debt have long been available, access to these options was often restricted for individual investors. Many private debt funds operated as Limited Partnerships (LPs), demanding individual subscriptions, accreditation, and imposing high minimum investments. Consequently, individual investors typically allocate less than 5% to alternative investments.

However, evolving financial markets have introduced new possibilities. Some individuals have begun accessing private debt through publicly available vehicles like interval funds, providing more inclusivity.

At Redwood, our investment philosophy has consistently revolved around developing solutions that emphasize managing drawdowns and mitigating downside risks. Seizing opportunities like these in the market plays a pivotal role in helping investors achieve their financial aspirations.

Leveling The Playing Field

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: