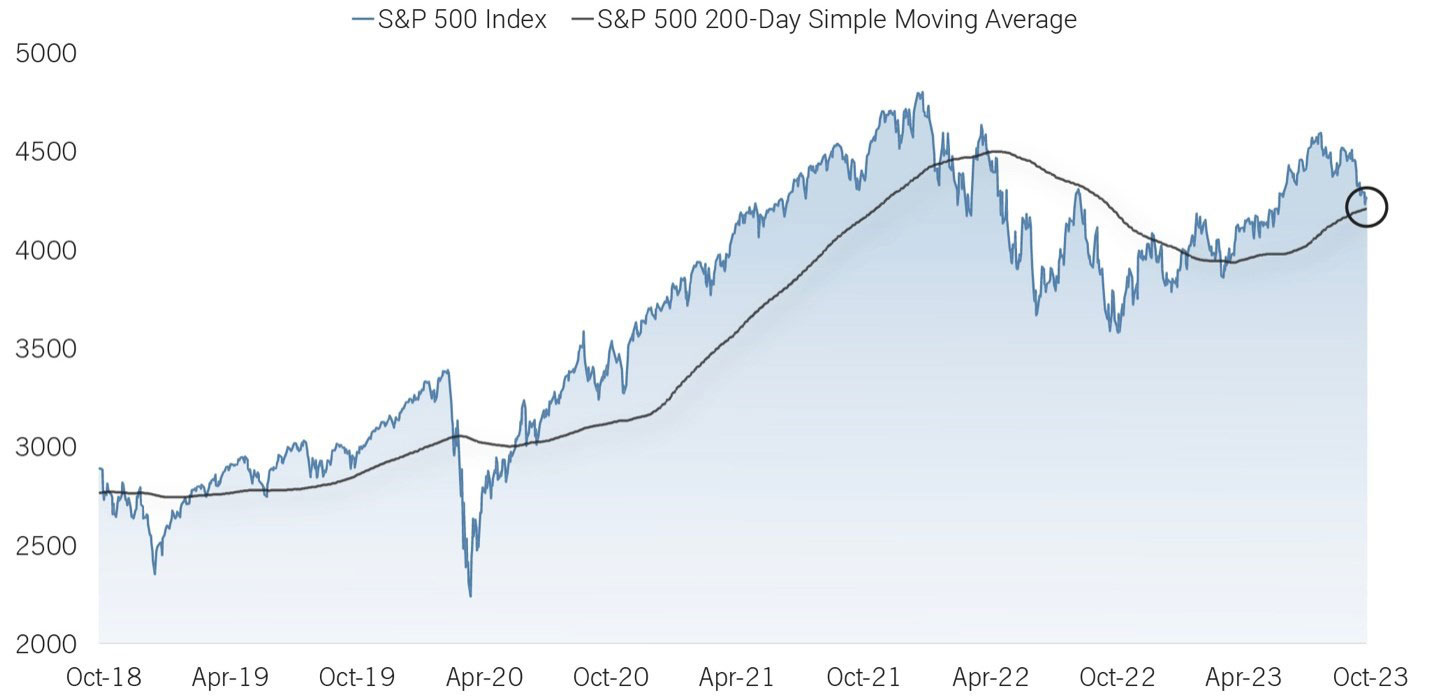

Simple Moving Averages (SMA) are common tools for traders and market analysts when it comes to gauging long-term market trends. In light of recent market turbulence, the S&P 500 has been approaching its 200-Day Moving Average, a level often regarded as a support point.

Remarkably, the index has remained above this threshold for an impressive 140 consecutive sessions as of Friday, marking its lengthiest streak since the post-pandemic surge witnessed in June 2020.

However, should the S&P 500 falter and dip below its 200-Day Moving Average, it could be interpreted as a potential indicator that the market is gearing up for further declines. Such uncertainty and volatility can understandably spark concerns among investors and may lead to hasty decision-making.

At Redwood, we prioritize helping clients stay within their risk tolerances in order to provide peace of mind throughout their financial journeys. This commitment is reflected in our RiskFirst® process, carefully designed to prepare us for diverse market conditions, seeking to ensure that we are well-equipped to navigate any challenges that may arise.

Approaching Critical Support

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: