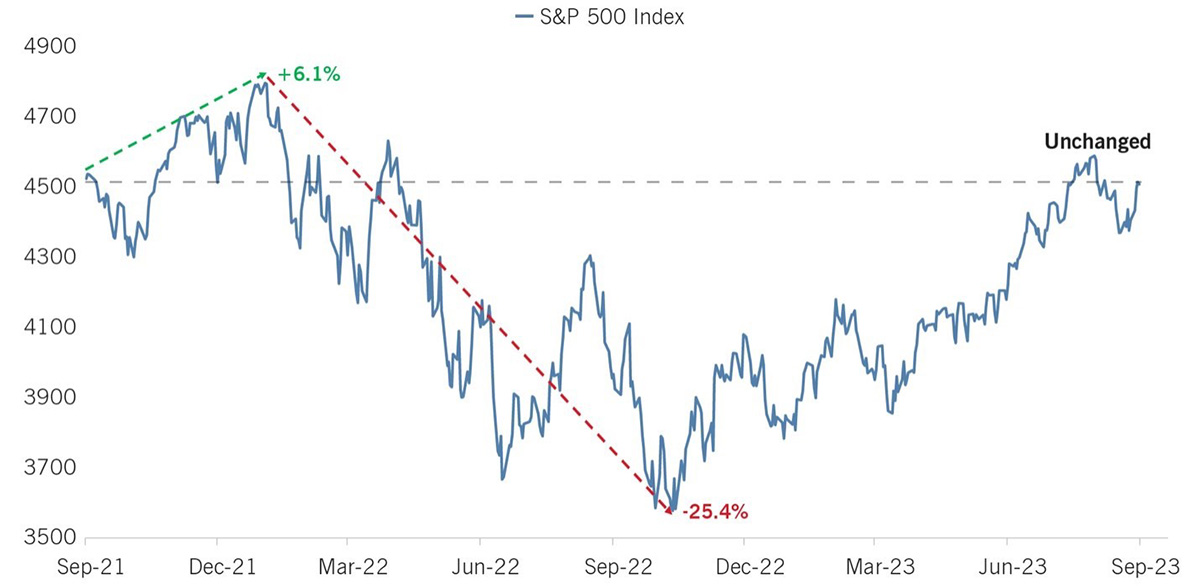

If you were to guess whether the S&P 500 was up, down, or flat from two years ago today, what would you guess? Many might be surprised to find out that it is flat! It might be hard to believe because from what we observe day to day, the market has been on a wild rollercoaster.

Late 2021 brought a robust rally, followed by a sharp downturn in 2022, and now we are in the middle of a significant recovery in 2023. Imagine this – if you entered the S&P 500 Index two years ago, your portfolio would have gone through a maximum gain of 6.8%, only to plummet to a maximum loss exceeding 25% and then gain its way back to your original account value. That kind of turbulence can certainly test an investor’s nerves.

Yes, the market has bounced back, but what truly matters is the journey. Investors had to endure this entire rollercoaster, often unsure if they’d hit rock bottom – only to break even. Watching the market erase nearly a quarter of its value at the lowest point can be emotionally challenging.

Our RiskFirst® process is our compass on this investment journey. It helps us define success within parameters that align with your comfort level. Following a disciplined process allows us to eliminate the need to focus on these wild swings and instead focus on what matters: making sure you are comfortable on your path toward achieving your goals.

Beyond Terminal Points

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: