It seems that the Fed might be nearing the end of its tightening cycle-or perhaps it’s already there. The latest inflation report raised a few eyebrows, coming in a bit higher than expected. However, it didn’t exactly rock the boat, and most investors seem to believe that Fed Chair Jerome Powell will maintain the status quo at the upcoming policy meeting.

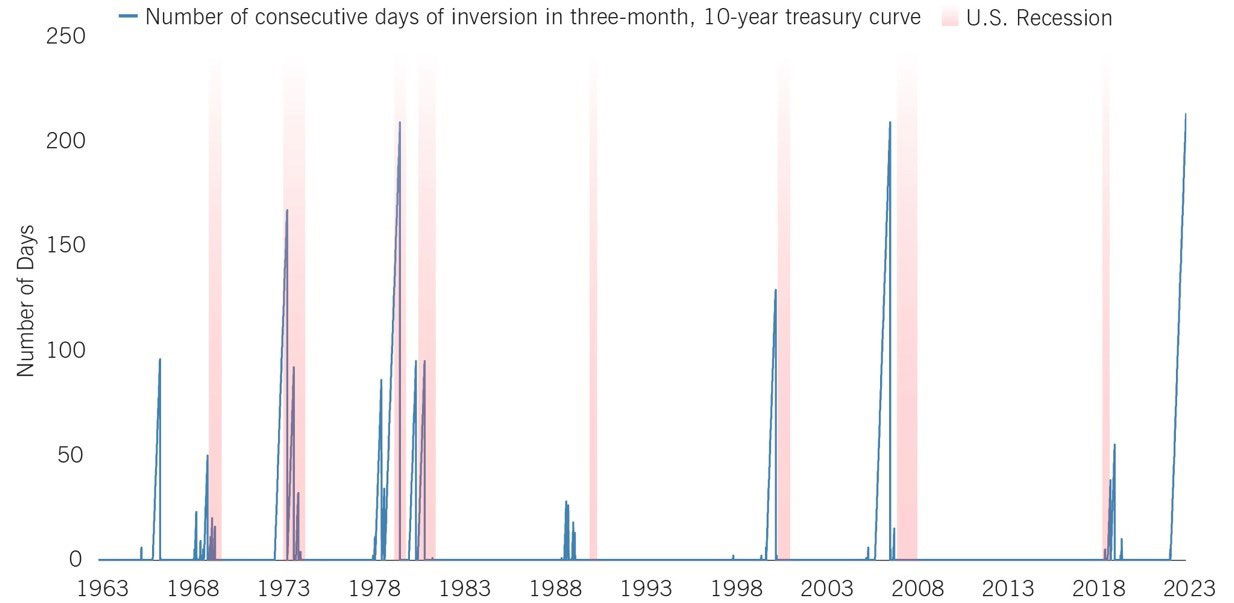

Despite the recent surge in economic data, there is a lot of speculation surrounding the treasury yield curve. Remarkably, as of last Thursday, three-month bill yields have remained higher than those of the 10-year note for an uninterrupted 212 trading days. This marks the lengthiest inversion since Bloomberg began tracking such data in 1962. It’s worth noting that previous inversions of this kind have often served as a precursor to economic recessions.

Will history repeat itself, or will the Fed be able to successfully sidestep a recession? The answer is impossible to predict. However, this uncertainty is precisely why we employ our RiskFirst® process. It offers investors a disciplined approach to managing their investments, with a primary focus on limiting portfolio drawdowns.

Inversion Indicator

- We believe the preservation of capital is key to consistent, long-term investment success.

- Our investment approach is grounded in economic theory and backed by quantitative analysis.

- Managing drawdown risk is a pillar from which we build our portfolios.

Watch our Intro Video! Learn a better way to invest: