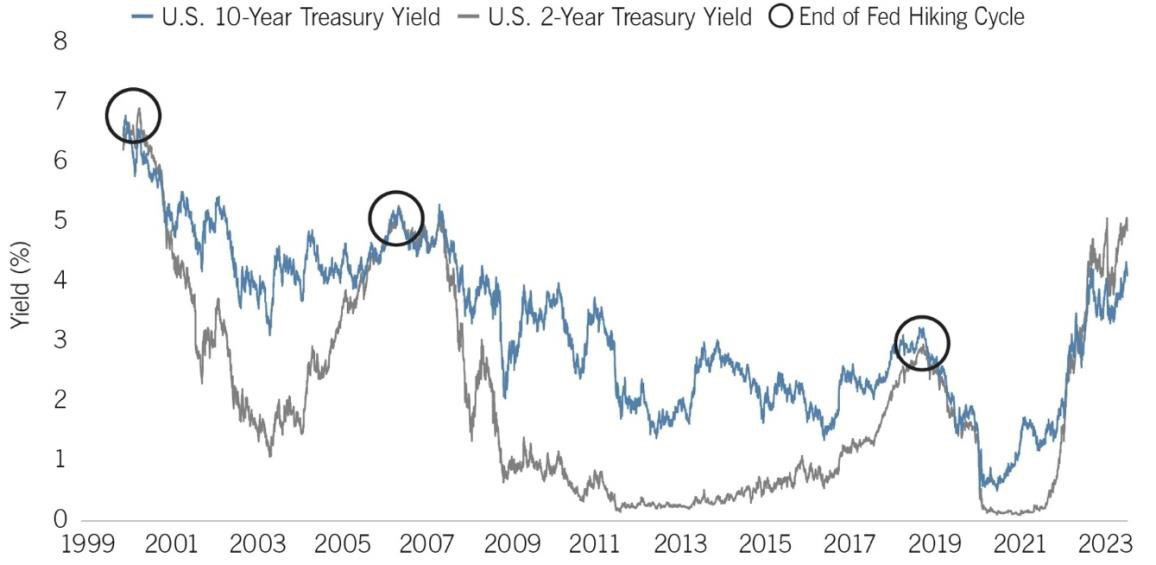

In the current phase of the Fed’s rate hike cycle, interest rates are hitting levels not seen in a decade, with cash yielding a solid 5%. It might seem enticing to park your investments in cash, especially given the lofty valuations in riskier assets. However, history teaches us a valuable lesson – veering away from a well-thought-out asset allocation to stash cash can bring about reinvestment risk.

Previous Fed tightening episodes have witnessed sharp drops in short-term yields as we approached the end of those cycles. Short-term treasuries like the 2-Year U.S. Treasury Yield dropped faster than their longer-term 10-year counterparts. This meant that investors hoping for prolonged high cash yields often ended up with lower yields when reinvesting.

Making impulsive investment decisions solely based on current attractive yields can result from a lack of a disciplined process. That’s where our RiskFirst® approach comes in handy. Here at Redwood, our purpose is to help investors establish and stick to a disciplined strategy while achieving their investment goals.

Reinvestment Risk?

Watch our Intro Video! Learn a better way to invest: